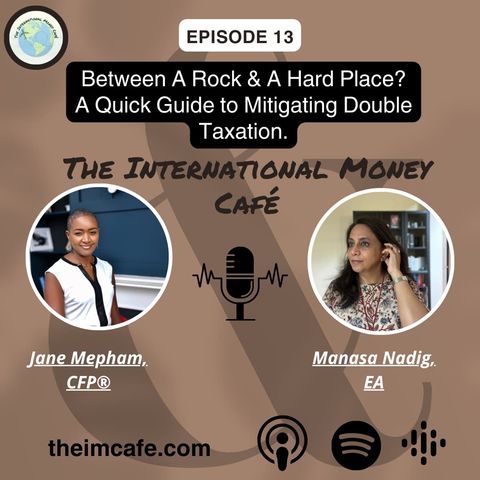

EP 13: Between A Rock & A Hard Place: A Quick Guide To Mitigating Double Taxation

Scarica e ascolta ovunque

Scarica i tuoi episodi preferiti e goditi l'ascolto, ovunque tu sia! Iscriviti o accedi ora per ascoltare offline.

Descrizione

The US taxes you on your worldwide income, regardless of where you live. If you live in the US and have foreign income or abroad, you have to report your...

mostra di piùThe other country in the equation is also very interested in your income, especially if you live there. Thus, the fear of being double-taxed is real and justified.

We are going to talk about Avoiding Double Taxation.

In this episode, we'll discuss the two main ways of mitigating this issue.

- FEIE - Foreign Earned Income Exclusion and

- FTC - Foreign Tax credits

In addition, we'll also discuss how income is classified, income sources, and tax treaties, as well as some ideas on dealing with stock options (RSU's ISO's, etc).

We'll end by discussing some financial planning opportunities that you can use in this situation. We will also discuss the idea that we are not just focused on saving taxes now but are taking a long-term approach.

The speakers' views and opinions discussed in this episode should not be considered financial, tax, or legal advice. Consult your advisor for any legal, cross-border tax, and financial advice.

Be sure to join the conversation by visiting our page The International Money Cafe

Or by following us on social media:-

Follow us on social media:- LinkedIn; Instagram; Twitter (X); Facebook

Informazioni

| Autore | The International Money Cafe |

| Organizzazione | MANASA NADIG |

| Sito | - |

| Tag |

Copyright 2024 - Spreaker Inc. an iHeartMedia Company

Commenti